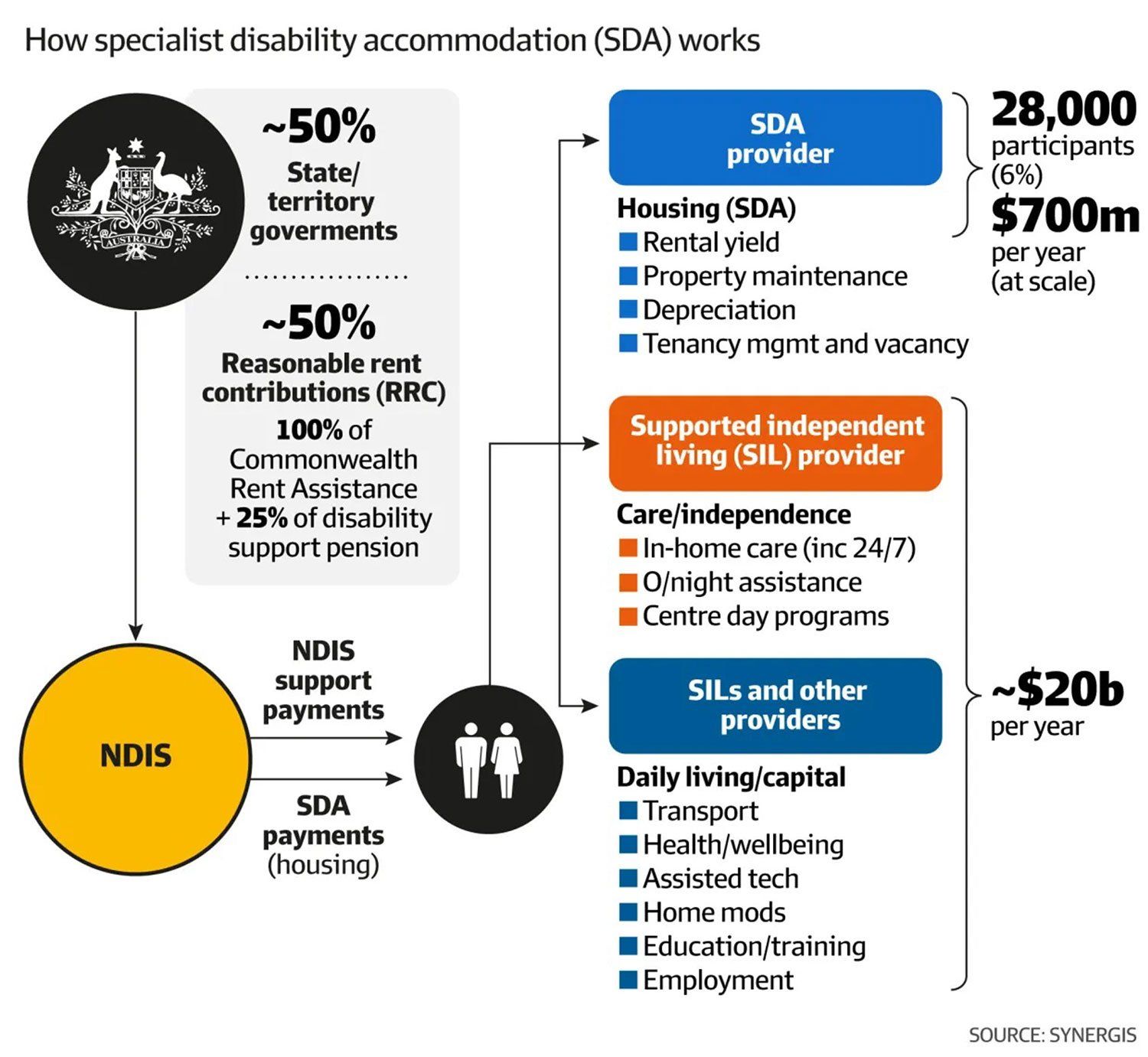

NDIS Specialist Disability Accommodation (SDA) is funding provided to enable people with extreme functional impairment or very high support needs to live in the community and receive the support they need.

The NDIS has allocated $700 million annually to fund Speciality Disability Accommodation.

Currently, there is a shortage of adequate NDIS housing for people with disabilities because current suppliers are unable to meet the housing demand. It is estimated that A$5 Billion will be required to fulfil the NDIS housing objectives for Special Disability Accommodation and SDA participants. This government's new program to build NDIS housing has inspired private investors to support the initiative and has already resulted in investments and the creation of new housing.

All Australians can now feel confident that they or a family member who is permanently or significantly disabled will be able to move into a home that suits their needs and requirements thanks to the NDIS SDA housing scheme. The NDIS ensures that people with a disability receive the care and services they need, and SDA funding helps provide the bricks-and-mortar housing in the form of livable homes for a small number of NDIS participants who qualify for SDA funding.

A liveable home is one that can meet the diverse demands of its residents over the course of their lives. These houses must have simple access, simple to navigate through, and economical customisation. Housing providers must be able to meet participant requirements and satisfy changing occupant needs, all while ensuring participant maximum independence.

Of the estimated 50,000 NDIS participants who will require specialised housing by 2030, a large number currently lack access to Specialist Disability Accommodation simply because there isn’t enough being built. In addition, a large proportion of the current disability housing such as institutional group homes and basic category disability housing needs upgrading or redevelopment in the near future. NDIS Property Australia supports participants with a forever home that helps create independence, improves the quality of life, and assists caregivers.

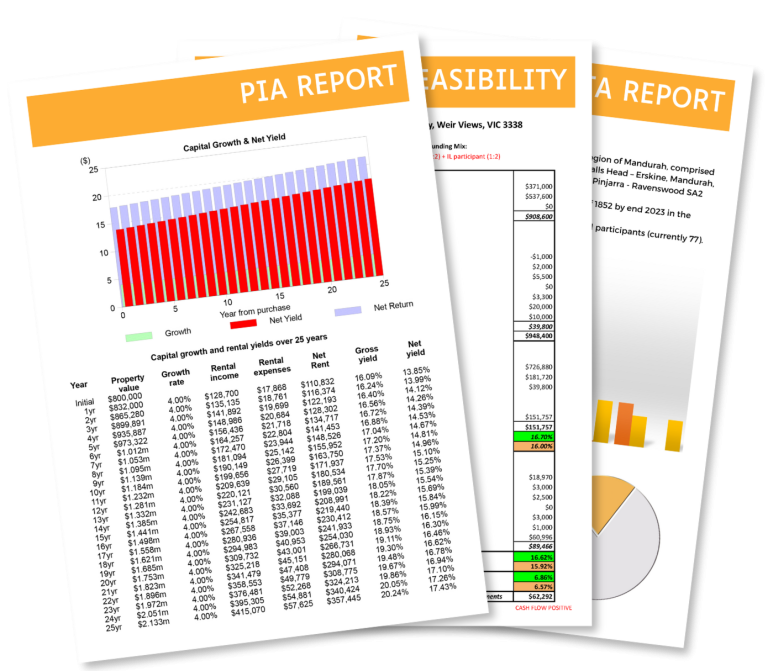

We strive to provide ethical investment opportunities with sustainable long-term returns for Investors and Owner-Occupiers. We partner with builders, developers, and NDIS housing providers to provide consultancy and advice to investors and also to participants themselves looking for a forever home.